CFOs Guide to Operational Restructuring

Restructuring is essential for aspiring CFOs, shaping a company’s stability, operations, and growth. As businesses evolve, ongoing adjustments are necessary to stay competitive. Mastering different types of restructuring and leading them effectively positions CFOs for long-term success.

1. Managing Finances

Financial restructuring involves reorganizing debt, equity, and working capital. It helps improve cash flow, reduce debt, and strengthen financial stability.

2. Handling Ownership Changes

Ownership restructuring includes buyouts, demergers, and changes to controlling parties. CFOs need to understand how these changes affect company control and investor relationships.

- Improving Operations

Operational restructuring focuses on simplifying business divisions, redefining roles, and upgrading processes. This leads to better efficiency and customer service.

4. Navigating Legal Structures

Legal restructuring might involve changing group structures or moving the top company’s location. CFOs must ensure compliance and create a structure that supports growth.

Understanding and leading these activities equips CFOs to drive long-term success and adaptability in a competitive market.

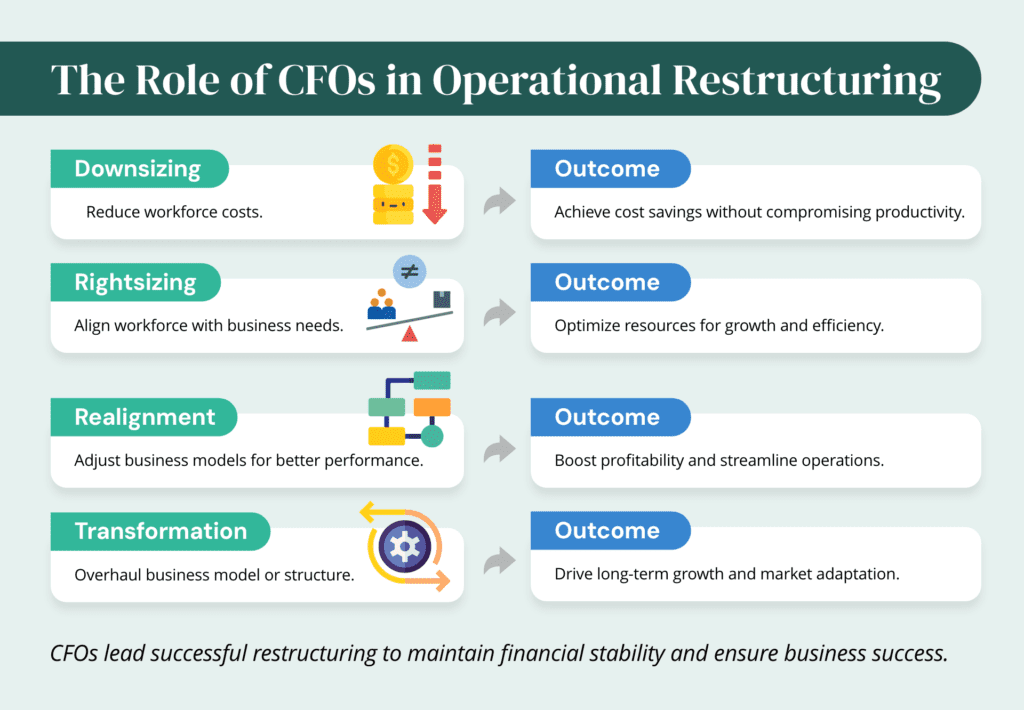

The Role of CFOs in Operational Restructuring

Aspiring CFOs play a crucial role in leading and advising on restructuring strategies. They must ensure these projects are executed efficiently while balancing financial goals and organizational stability. Understanding the four main types of operational restructuring is essential:

- Downsizing: Reducing workforce costs by cutting positions, wages, or hours. CFOs must assess the financial savings against potential productivity losses and morale impacts.

- Rightsizing: Matching workforce needs by hiring, training, or reassigning staff. CFOs ensure that resources are aligned with business objectives for growth and efficiency.

- Realignment: Adjusting business models to improve efficiency or profitability. This may involve optimizing production, sales, or distribution methods. CFOs evaluate the financial feasibility and long-term impact of these changes.

- Transformation: Overhauling the business model by entering new markets, launching new products, or reconfiguring the organizational structure. CFOs drive the financial planning and investment decisions required for such significant shifts.

Balancing Financial and Human Considerations

Operational restructurings often come with difficult consequences, such as job losses, pay cuts, or role changes. CFOs must navigate these challenges with transparency and empathy, balancing financial outcomes with employee well-being.

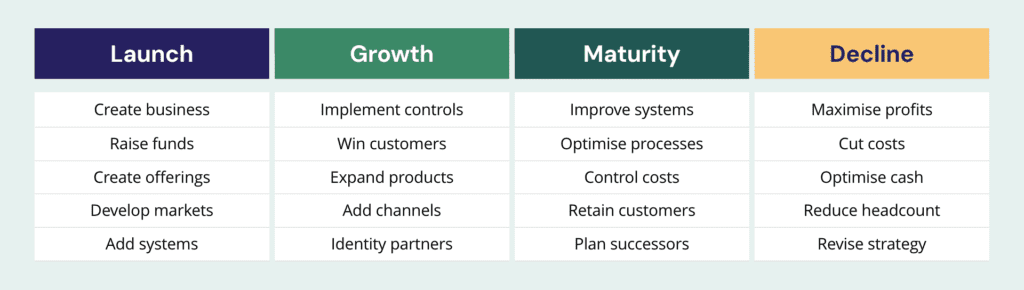

The following diagram illustrates some of the typical strategic objectives that management need to achieve during each stage of your journey:

Aspiring CFOs need to master operational restructuring to succeed in their careers. Many companies wait until they are under stress or facing a crisis before making changes, but smart CFOs know it’s better to act early.

Recognizing the Warning Signs

Early signs that a company needs restructuring include:

- Decreasing revenues while costs remain the same

- Declining profit margins on core products or services

- Lower productivity across the business

- External or internal changes affecting the business model

By spotting these trends early, CFOs can step in before problems worsen.

Balancing Strategy and Stability

Operational restructurings can disrupt business operations, causing issues like:

- Customer service problems

- Shipment delays

- Production stoppages

To minimize these challenges, CFOs should:

- Consult employees and gather their input

- Develop a detailed plan to guide the changes

- Ensure operations continue smoothly throughout the process

The Key to Long-Term Success

When done right, operational restructuring strengthens a company and positions it for future growth. Aspiring CFOs who understand how to lead these changes will become invaluable leaders, helping their organizations adapt, thrive, and reach new heights.

Take the time to assess your company’s restructuring needs, choose the right approach, and execute with precision—your organization’s future depends on it.

Ready to lead impactful change and elevate your finance expertise? Join us at the Future CFO Program Preview Event to gain the strategies and insights needed to become a transformative leader. Take the first step toward advancing your career and driving long-term success.

Responses