Which Skills Do Modern-Day Finance Professionals Need the Most?

Table of Contents

In today’s rapidly evolving business landscape, the role of finance professionals has become increasingly complex and multifaceted. Gone are the days when traditional accounting and reporting skills were enough to excel in the field. Modern-day finance professionals need to possess a diverse set of competencies to navigate the challenges and seize the opportunities presented by the changing business environment.

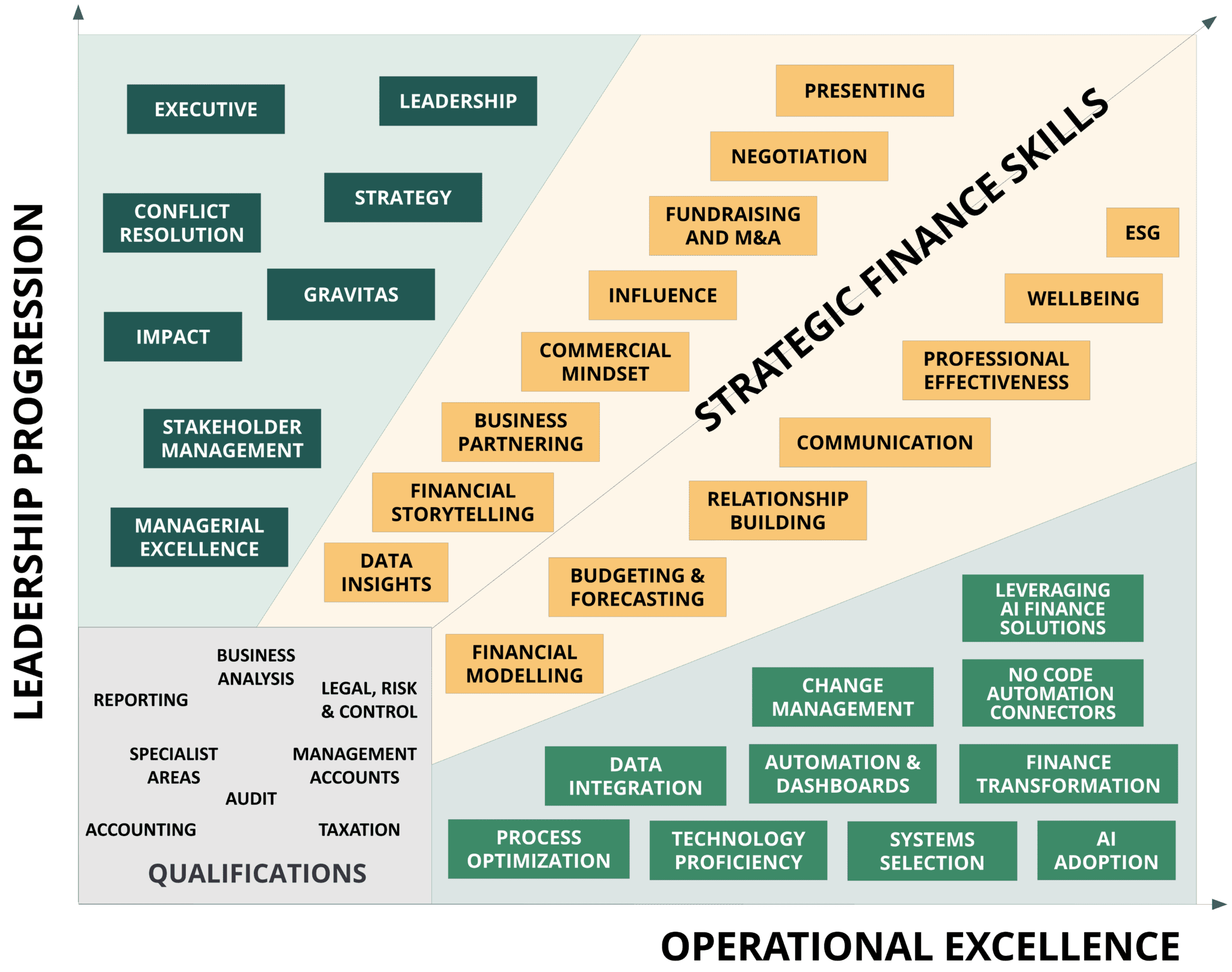

According to Dan Wells, our founder and CEO, the critical skills for financial excellence can be divided into three key areas:

- Leadership Progression

- Strategic Finance Skills

- Operational Excellence.

While traditional finance qualifications and in-house training programs provide a solid foundation, there are significant gaps in these crucial areas that need to be addressed.

Leadership Progression:

As the role of finance professionals continues to evolve, the ability to demonstrate strong leadership skills has become increasingly crucial. Finance leaders must be able to drive strategic decision-making, inspire their teams, and effectively communicate with a diverse range of stakeholders.

At the core of leadership progression is the development of strategic planning capabilities. Finance professionals need to think beyond the numbers and develop a deep understanding of the broader business landscape. This involves the ability to analyze market trends, identify emerging opportunities, and align financial strategies with the organization’s overarching goals.

Closely tied to strategic planning is the skill of change management. In today’s volatile business environment, finance leaders must be adept at navigating organizational change and guiding their teams through periods of transformation. This requires the ability to anticipate and mitigate risks, communicate the rationale for change, and foster a culture of adaptability and resilience.

People management is another critical component of leadership progression. Finance professionals must be able to build and motivate high-performing teams, delegate responsibilities effectively, and provide constructive feedback. This includes developing emotional intelligence, conflict resolution skills, and the ability to empower and develop their team members.

Effective communication is the glue that binds these leadership competencies together. Finance leaders must be skilled at translating complex financial information into meaningful insights, tailoring their messaging to different stakeholder groups, and fostering collaborative relationships across the organization.

By honing these leadership skills, finance professionals can position themselves as strategic partners, driving business success and contributing to the long-term growth and resilience of their organizations. As the finance landscape continues to evolve, the ability to lead with vision, agility, and people-centric approach will be the hallmark of the modern-day finance professional.

Strategic Finance Skills:

In the modern business landscape, the role of finance professionals has evolved beyond traditional accounting and reporting functions. Today’s finance teams are expected to be strategic partners, providing valuable insights and foresight to drive organizational decision-making.

At the heart of strategic finance skills is the ability to analyze complex data and translate it into actionable insights. Finance professionals must be adept at financial modeling, scenario planning, and data visualization to uncover trends, identify risks, and evaluate the potential impact of various business decisions.

Financial modeling is a crucial skill that enables finance leaders to simulate different scenarios and test the viability of strategic initiatives. By developing robust financial models, finance professionals can provide decision-makers with a comprehensive understanding of the financial implications of various courses of action. This may involve projecting revenue streams, forecasting cash flows, and evaluating the impact of changes in market conditions, customer behavior, or operational factors.

Closely tied to financial modeling is the skill of scenario planning. In an increasingly volatile and unpredictable business environment, finance professionals must be able to anticipate and adapt to market trends, economic fluctuations, and industry disruptions. By developing multiple scenarios and contingency plans, finance leaders can help their organizations navigate uncertainty and seize emerging opportunities.

Risk management is another critical component of strategic finance skills. Finance professionals must be able to identify, assess, and manage a wide range of risks, from financial and operational to regulatory and reputational. This involves developing robust risk assessment frameworks, implementing effective risk mitigation strategies, and continuously monitoring the evolving risk landscape. By proactively addressing potential risks, finance teams can help their organizations maintain financial stability and resilience.

Alongside technical finance skills, strategic finance professionals must also possess a deep understanding of the business. This includes knowledge of the organization’s value proposition, the drivers of profitability, and the interdependencies between different business functions. By aligning financial strategies with the overall business objectives, finance leaders can contribute to the organization’s long-term success and competitive advantage.

Effective communication and collaboration are essential for translating strategic finance insights into tangible business impact. Finance professionals must be able to present complex financial information in a clear and compelling manner, tailoring their messaging to the needs and priorities of diverse stakeholders, from the C-suite to operational teams.

By developing these strategic finance skills, finance professionals can position themselves as indispensable partners, driving informed decision-making, optimizing resource allocation, and contributing to the organization’s overall strategic direction. As the business environment continues to evolve, the ability to think strategically, anticipate change, and provide data-driven insights will be the hallmark of the modern finance leader.

Operational Excellence:

Operational efficiency and accuracy have become critical success factors for finance teams. Finance professionals must possess a keen eye for detail, a strong grasp of process optimization, and the ability to leverage technology to streamline operations and reduce errors.

At the core of operational excellence is the ability to design and implement robust financial processes and controls. This includes developing standardized procedures for tasks such as accounts payable and receivable, payroll management, and financial reporting. By establishing clear workflows and implementing effective internal controls, finance teams can enhance the reliability and integrity of financial data, reducing the risk of errors and compliance issues.

Attention to detail is a hallmark of operational excellence in finance. Finance professionals must be meticulous in their work, ensuring that every transaction is accurately recorded, every reconciliation is completed, and every report is free of errors. This attention to detail not only enhances the credibility of the finance function but also supports informed decision-making and regulatory compliance.

Closely tied to process optimization is the skill of leveraging technology to drive operational efficiency. Finance professionals must be adept at identifying and implementing the right tools and systems to automate repetitive tasks, enhance data management, and improve decision-support capabilities. This may involve the use of enterprise resource planning (ERP) systems, data analytics platforms, and robotic process automation (RPA) solutions.

By harnessing the power of technology, finance teams can streamline their operations, reduce manual errors, and free up resources to focus on more strategic initiatives. This may include automating routine tasks like invoice processing, payroll calculations, and financial reporting, allowing finance professionals to devote more time to value-added activities such as financial planning, risk management, and business partnering.

In addition to technical skills, finance professionals must also develop a deep understanding of the organization’s operational landscape. This includes knowledge of the company’s products, services, and supply chain, as well as the interdependencies between different business functions. By aligning financial operations with the broader organizational context, finance teams can contribute to the optimization of end-to-end business processes, driving cost efficiencies and enhancing overall operational performance.

Effective communication and collaboration are essential for ensuring that operational excellence is embedded throughout the organization. Finance professionals must be able to work closely with cross-functional teams, sharing best practices, identifying areas for improvement, and fostering a culture of continuous optimization.

By prioritizing operational excellence, finance teams can not only enhance the accuracy and reliability of financial data but also free up resources to focus on more strategic initiatives. As the business environment continues to evolve, the ability to streamline operations, leverage technology, and drive continuous improvement will be the hallmark of the modern finance function.

Investing in Training and Development

To bridge skill gaps effectively, finance professionals and their organizations must invest in targeted training and development initiatives. These efforts should encompass a blend of in-house training, bespoke advisory services, and collaboration with industry experts and training providers.

- In-house Training offers finance teams opportunities to develop skills tailored to their organization’s specific needs. This can include workshops, mentorship programs, and on-the-job training that enhance leadership, strategic finance, and operational expertise.

- Bespoke Advisory Services provide access to experienced consultants and subject matter experts who offer customized guidance in areas like financial modeling, risk management, and process optimization. These services help organizations stay ahead of industry trends and implement best practices, ensuring that finance professionals are equipped to navigate evolving challenges.

- Collaboration with Industry Experts and leading training providers is another powerful strategy. Partnerships with academic institutions, professional associations, and industry-specific organizations provide cutting-edge knowledge, innovative learning methodologies, and opportunities for peer-to-peer networking. These collaborations foster a culture of continuous learning and knowledge-sharing, which is critical to staying competitive in the dynamic finance landscape.

By prioritizing skill development in these areas, finance professionals can position themselves as strategic partners who drive business success and contribute to organizational resilience. Today’s finance leaders must master competencies in strategic planning, change management, data analysis, and process optimization to adapt and innovate continuously.

For more insights on navigating the modern finance landscape, visit the Grow CFO website at https://www.growcfo.net/corporate/exlf/. This resource offers expert guidance, best practices, and actionable strategies to empower finance professionals to excel in an ever-changing business environment.

Achieving financial excellence is not a one-size-fits-all journey. It requires a tailored, evidence-based approach aligned with organizational goals. By investing in essential skills development, finance teams can unlock new levels of strategic impact, operational efficiency, and success.

Take the first step toward becoming a modern finance leader. Explore resources at https://www.growcfo.net/corporate/exlf/ and embark on your path to financial excellence.

Responses