Streamlining month-end: Cut days with automation & integration

Table of Contents

Is your month-end closing process holding you back? For growing businesses, consolidating accounts across multiple entities and delivering accurate reports on time can feel like an uphill battle. Without a streamlined approach, these mundane manual processes can delay reporting, limit visibility, and hinder strategic decision-making. Automation can deliver results, but it’s not a quick fix. Only by first standardizing and streamlining processes will it drive efficiency and deliver lasting value.

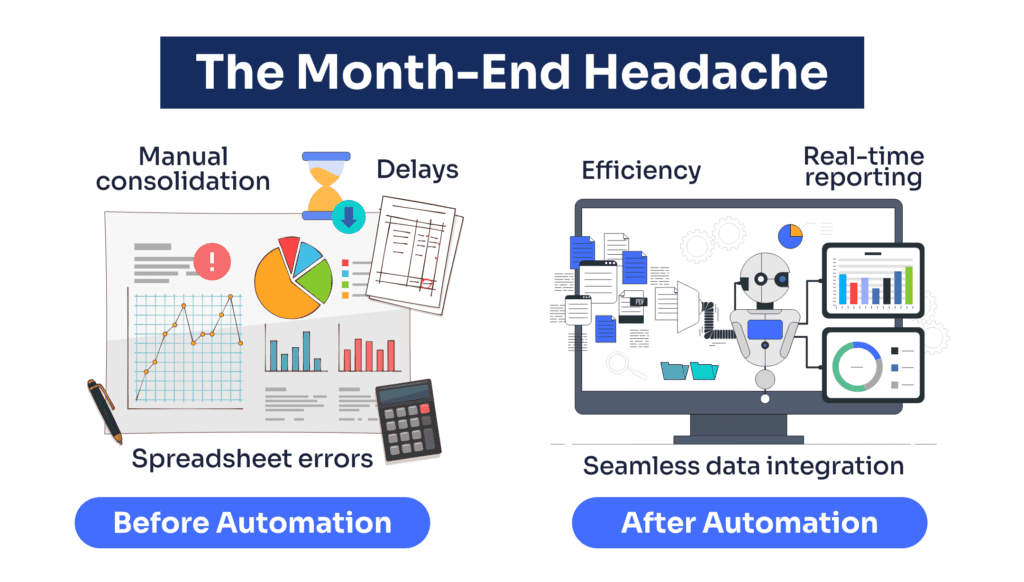

Consolidating accounts across subsidiaries is challenging, with differing data sources, accounting policies, and intercompany transactions to reconcile. These complexities can result in inconsistencies in month-end data, frequent data re-posting, and a lack of visibility into the overall financial health of growing businesses.

Outdated legacy systems and dependence on error-prone spreadsheets further exacerbate the issue, as finance teams waste valuable time on repetitive tasks that could be automated. This can lead to delayed reporting, inaccurate accruals, and unexplained variations in margins, all of which undermine the confidence of non-finance stakeholders in the reliability of financial data.

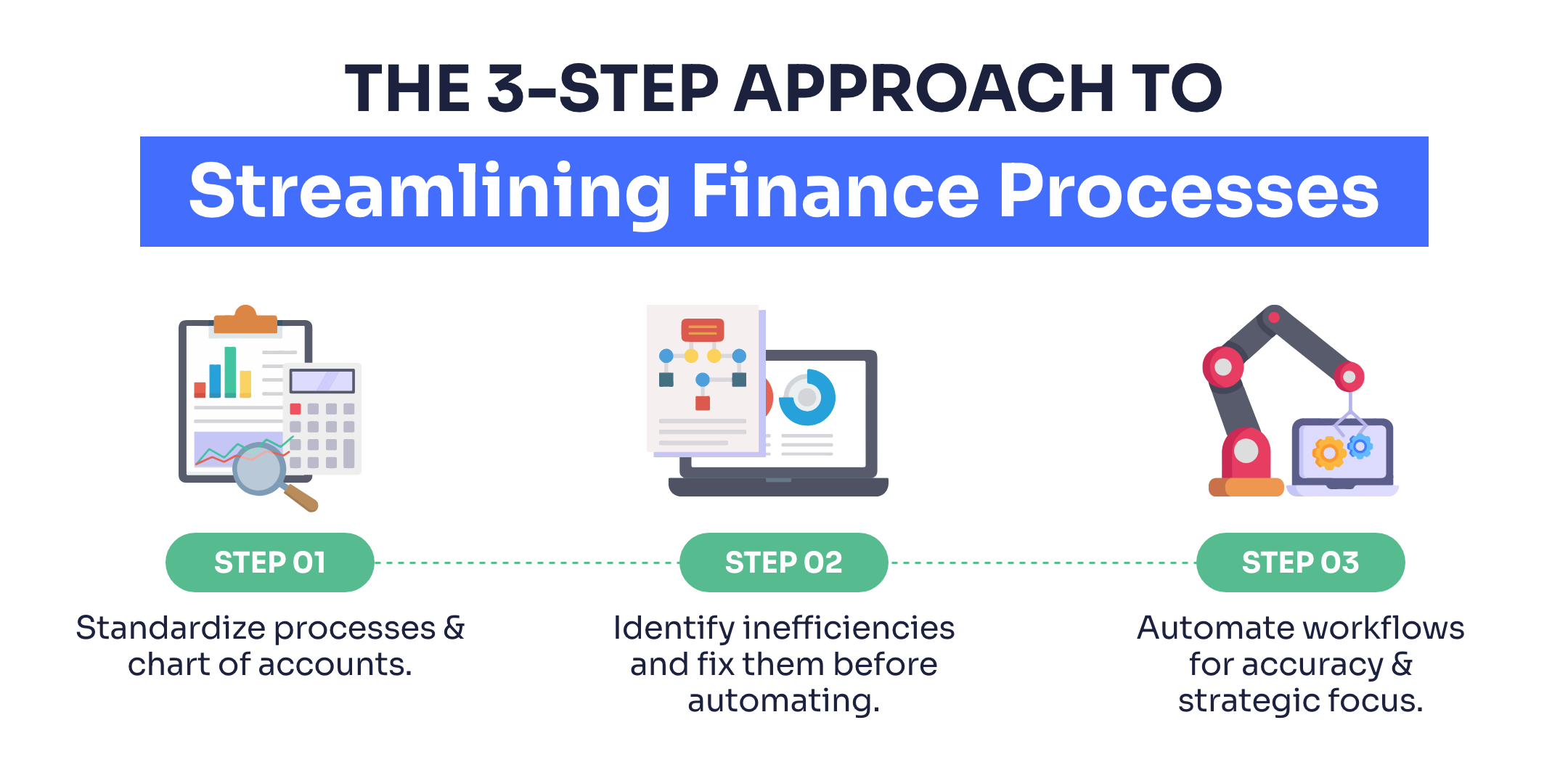

What’s the key to successful automation? For growing businesses, the answer lies in first standardising and streamlining finance processes. Begin with a consistent chart of accounts across all entities, then identify and align transaction processes that vary across units.

Addressing inefficient or redundant processes upfront is crucial – without it, automation can amplify existing challenges. To unlock its potential, streamline workflows, remove manual handoffs, and standardize data capture. Map out your processes and question every step.

Implementing new technology without first optimising underlying processes can add complexity and introduce new challenges. Instead, businesses should focus on refining their finance function, identifying key risk areas, and ensuring continuity in crucial processes like accounts payable and receivable. Pinpointing where errors occur and addressing their root causes will deliver long-term benefits.

The power of automation.

Automation can transform the month-end close for busy finance teams, minimising the time and effort needed while improving accuracy and compliance. Automated consolidation and reconciliation processes can effortlessly gather data from multiple systems, facilitating real-time reporting and business intelligence.

By leveraging automation, finance teams can streamline workflows, reduce errors, and free up time to focus on strategic initiatives. Automated consolidation and reconciliation can shave days off the month-end close process while providing finance leaders with the timely, reliable data they need to make informed decisions.

Automated workflows can remove the need for manual data entry and streamline tasks like bank reconciliations, accruals, and intercompany eliminations. This improves accuracy and allows finance teams to redirect their focus from “firefighting” to strategic planning and analysis.

What does the future hold?

The emergence of AI-powered accounting is already transforming month-end reporting by automating repetitive tasks, enhancing accuracy, and accelerating the close process. AI-enabled journaling and bank reconciliation can minimise errors and ensure more timely financial reporting, freeing finance teams to focus on strategic analysis and adding more value to the business overall.

Advanced AI tools can also enable a more conversational, intuitive interaction with the finance system, allowing users to instantly request specific reporting data in different formats.

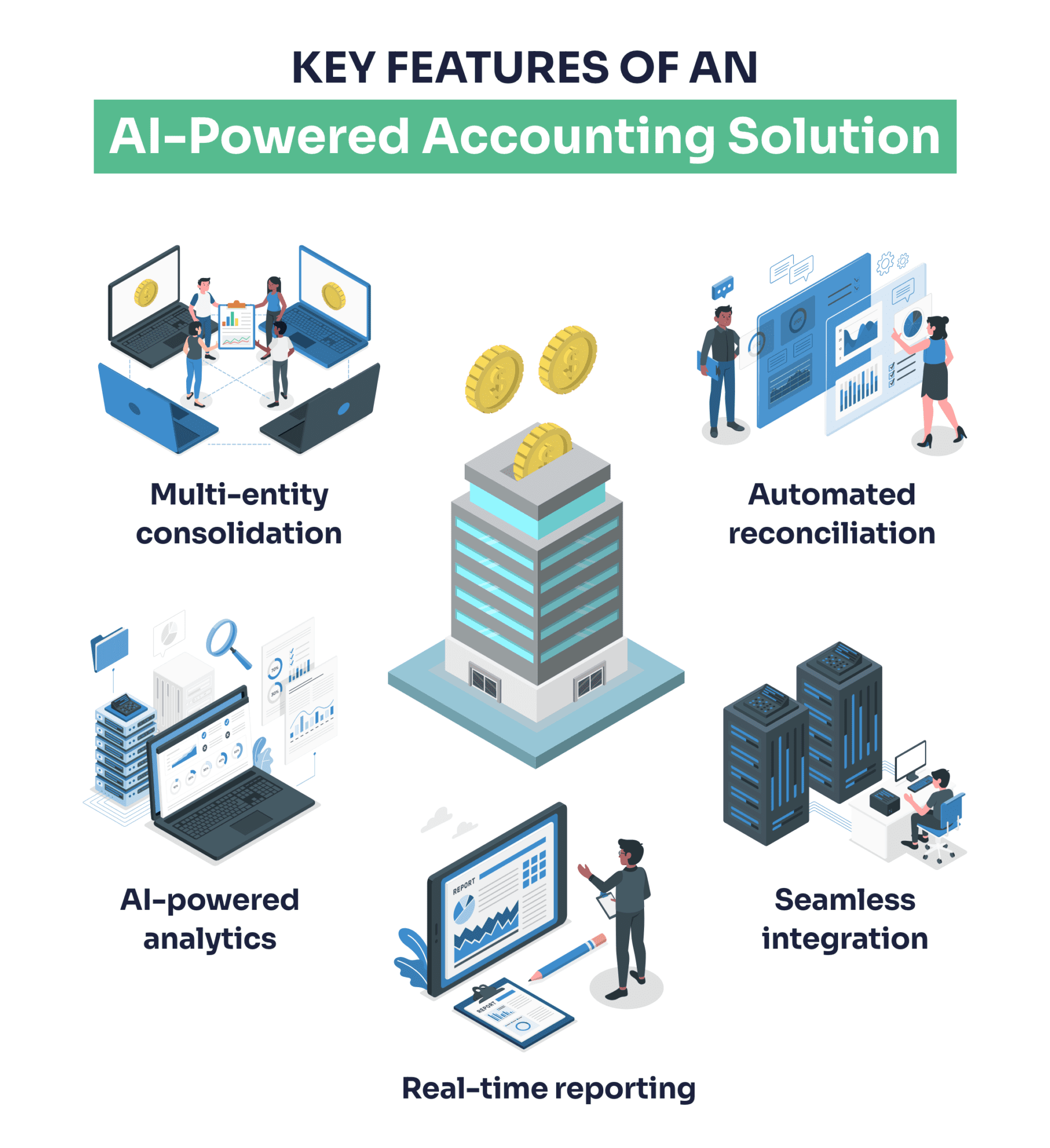

To streamline the month-end close, growing businesses should look for an accounting solution with the following key features:

- Automated multi-entity consolidation: The ability to seamlessly integrate and consolidate financial data from multiple entities, currencies, and accounting policies into a centralized, unified source of information.

- Seamless data integration: Seamless integration with other business systems eliminates manual data entry and ensures a smooth flow of accurate information across the organization.

- Automated reconciliation and reporting: Automated bank reconciliation, accrual processing, and real-time reporting capabilities to enhance accuracy, reduce errors, and free up time for strategic analysis.

- Robust business intelligence and analytics: Intuitive reporting and analytics tools provide finance leaders with a comprehensive overview of the organization’s financial health and enable informed, data-driven decision-making.

- A clear development roadmap: A system that will embrace further AI advances, particularly the use of AI bots.

Beware of aging solutions that are still struggling to come to terms with cloud accounting. The AI revolution that is upon us is built in the cloud. Modern mid-market software providers such as AccountsIQ will give you these capabilities.

Find Out More

Taylor Andrew, Business Development Manager at AccountsIQ, joined Adam Shilton from GrowCFO for a webinar discussing data connectivity and insights from the ‘Confessions of the Finance Function’ report.

The session highlights a stark divide between the experiences of junior and senior finance professionals, revealing alarming statistics on the time spent on manual, repetitive tasks like data collection and reporting – and the toll this takes on job satisfaction and retention.

You can watch the replay to uncover key insights here.

By adopting a finance solution that combines automation and data integration, finance teams will no longer dread the month-end close, and gain back significant time for value-adding work. With the right accounting solution in place, businesses can gain better control over a future-proofed finance with a positive impact across the whole business.

Responses