CFO Skill: Embed Finance Across the Company

Creating a financial culture means aligning every employee with your business’s commercial goals and integrating these objectives into all activities. However, employees outside of the finance department often either misunderstand your company’s financial needs or lack commitment to meeting them.

Establishing a strong financial culture across your organization is crucial for delivering your strategic plan and enhancing the role of finance in daily operations and decision-making. The benefits include:

● Building a solid financial foundation for growth and profitability.

● Positioning finance as the go-to resource for support.

● Increasing finance’s involvement in company activities.

● Expanding finance’s influence across the business.

● Creating more opportunities for finance to add value to each department.

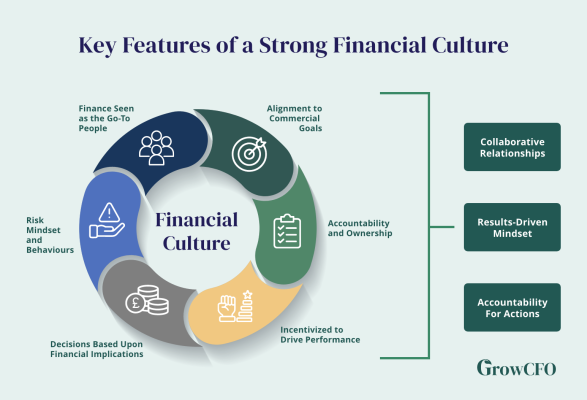

The following diagram outlines the features of a financial culture within your company:

A strong financial culture ensures that all employees are aligned with the company’s commercial goals, fostering collaboration and consistency across departments. This alignment enhances decision-making, supports strategic initiatives, and drives overall business growth and profitability.

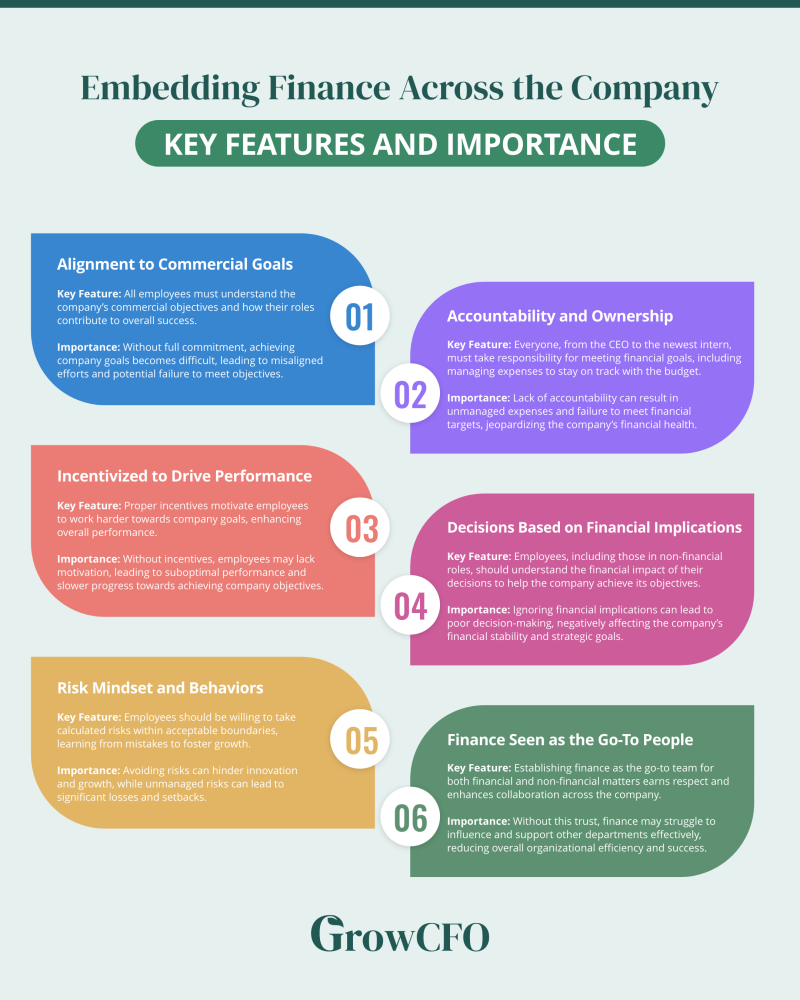

There are 6 key features to pay attention to of a finance culture:

- Alignment to Commercial Goals: All employees must understand the company’s commercial objectives and how their roles contribute to overall success. Full commitment is essential to achieving these goals.

- Accountability and Ownership: Everyone, from the CEO to the newest intern, must take responsibility for meeting financial goals, including managing expenses to stay on track with the budget.

- Incentivized to Drive Performance: Proper incentives motivate employees to work harder towards company goals, enhancing overall performance.

- Decisions Based on Financial Implications: Employees, including those in non-financial roles, should understand the financial impact of their decisions to help the company achieve its objectives.

- Risk Mindset and Behaviors: Employees should be willing to take calculated risks within acceptable boundaries, learning from mistakes to foster growth.

- Finance Seen as the Go-To People: Establishing finance as the go-to team for both financial and non-financial matters earns respect and enhances collaboration across the company.

Mike Whitmire , CEO and founder of FloQast, also shared his insights on how technology shapes financial culture in a conversation with GrowCFO.

Key takeaways from the discussion were:

- Integrate Finance in Decision-Making: Involve finance in strategic and operational decisions to ensure financial implications are considered.

- Build a Financially Literate Workforce: Provide financial training for all employees to understand and support the company’s commercial goals.

- Establish Accountability at All Levels: Foster a culture of financial responsibility from the CEO to every employee.

- Create Effective Incentive Programs: Align incentives with financial performance to motivate employees.

- Promote Finance as a Strategic Partner: Position finance as a trusted advisor and go-to resource for all departments.

CFOs must integrate finance throughout the company to support business objectives and deliver the financial plan. This involves building strong relationships with other teams, effective communication, and keeping everyone informed to ensure each team receives the necessary financial insights to achieve their goals.

Join our upcoming Future CFO preview event to learn more about enhancing your leadership skills across various CFO functions:

Responses