CFOs Guide to Successful Change Management

For CFOs, a structured measurement process is essential for successful change management. Without clear metrics, projects may lack accountability and fail to demonstrate impact, leading to stakeholder pressure for data-driven results.

Key steps for effective measurement:

Define Success Early

Set clear metrics before launching the project.

Align objectives with stakeholders.

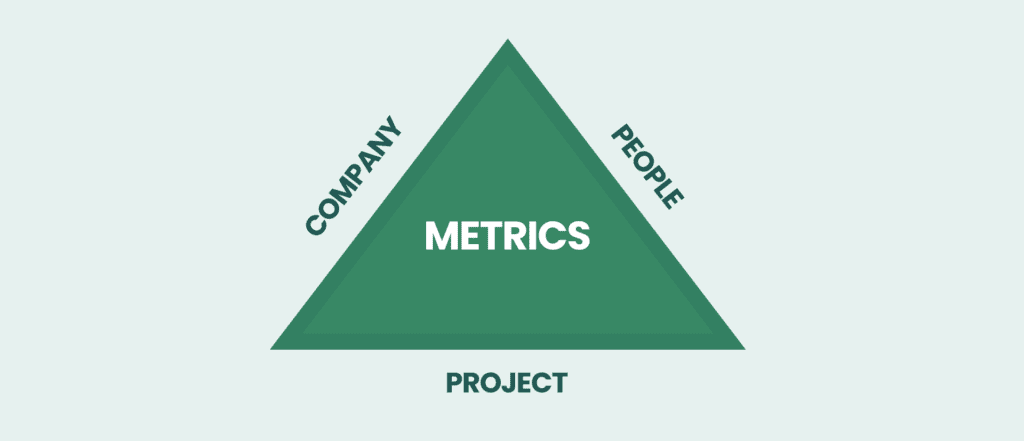

Measure Across Three Areas

Company – Financial performance and strategic impact.

People – Employee adoption and readiness.

Project – Execution efficiency and quality.

Secure Stakeholder Buy-In

Use data to communicate impact and adjust strategies.

Improve transparency and long-term success.

A structured approach ensures CFOs can track progress, refine processes, and drive meaningful change.

CFOs must select the most relevant metrics for each project based on its specific nature, covering the following areas:

The impact on the company.

The effect on individuals involved.

The overall quality of the change management process.

Once key metrics are defined, a plan for data collection and review should be established. These metrics should be monitored throughout the project and beyond to assess the long-term impact of the change.

Capturing and tracking data may require collaboration with other teams across the organization, depending on the data sources and systems in place. Consider using automated dashboards to streamline data collection, ensuring efficiency and timely insights.

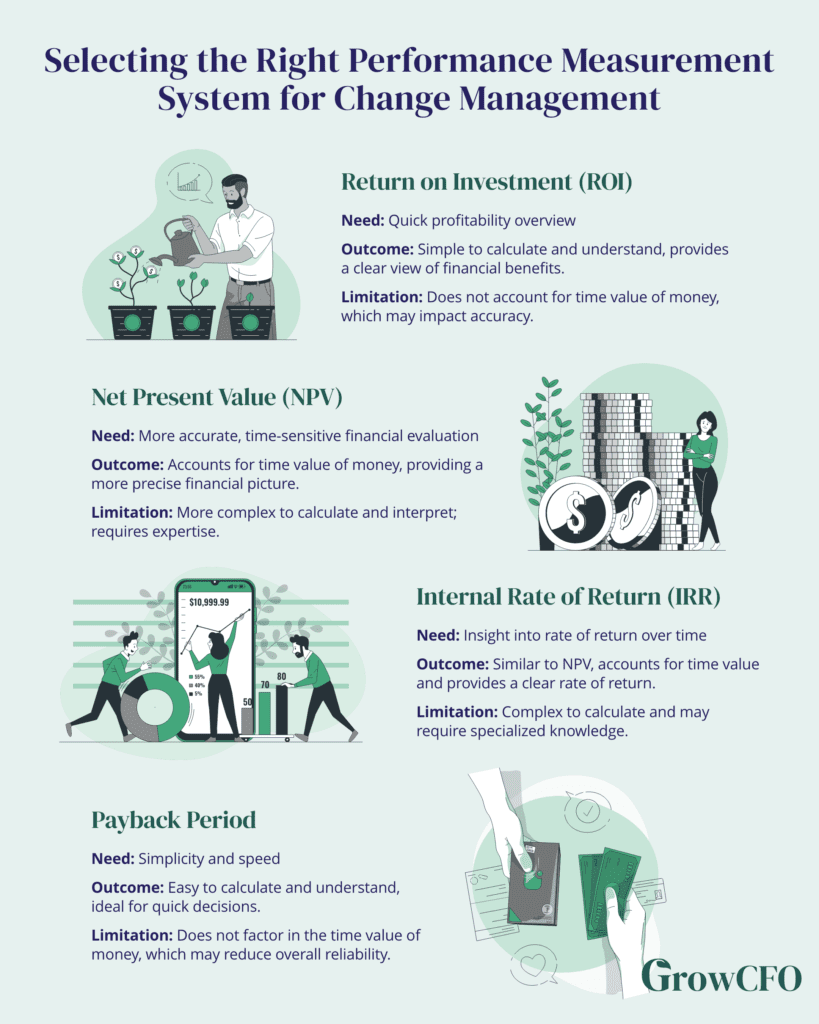

Selecting the Right Performance Measurement System for Change Management

To ensure the success of a change management project, CFOs must choose the right performance measurement system and be prepared to take action if the outcomes do not align with the objectives. After establishing clear metrics and a plan for collecting data, it is crucial to evaluate the performance using an appropriate system.

Here are four popular performance measurement systems, each with its own strengths and challenges:

- Return on Investment (ROI)

- Simple to calculate and understand, offering a good overview of profitability.

- However, it doesn’t consider the time value of money, which can limit its accuracy.

- Net Present Value (NPV)

- More accurate than ROI because it accounts for the time value of money.

- It can be complex to calculate and interpret, requiring more expertise.

- Internal Rate of Return (IRR)

- Similar to NPV, IRR accounts for the time value of money and provides insight into the rate of return.

- It can be difficult to calculate and may require specialized knowledge.

- Payback Period

- The simplest system, easy to calculate and understand.

- However, it doesn’t factor in the time value of money, which may impact its overall reliability.

By selecting the right performance measurement system and using it alongside predefined metrics, CFOs can ensure their change management initiatives are on track and take corrective action when necessary.

Each business will have unique priorities when it comes to change projects. CFOs must understand the strengths and limitations of each measurement system and select the one that aligns best with their goals to drive the desired outcomes.

Ready to lead impactful change and elevate your finance expertise? Join us at the Future CFO Program Preview Event to gain the strategies and insights needed to become a transformative leader. Take the first step toward advancing your career and driving long-term success.

Reserve your spot today:

Responses