The Vital Role of Fundraising for CFOs and Aspiring CFOs: Why It’s Crucial to Your Success

Table of Contents

Did you know that 68% of aspiring and first-time CFOs report having little to no fundraising experience?

This gap can derail your career, especially when you’re tasked with leading your company’s first fundraising round. Whether you’re navigating an overseas expansion, developing new technology, or seeking a cash infusion to revitalize growth, the fundraising process is essential—and your role as CFO is key.

Why Fundraising Matters for CFOs

As CFO, you are responsible for:

- Determining How Much to Raise

Assessing your company’s needs and deciding on the right amount of funding to secure. - Identifying the Right Funding Sources

Whether it’s equity capital from venture capitalists, private equity firms, or debt facilities from banks, your role is to select the best sources at each stage of your business’s lifecycle. - Providing Accurate Financial Information

Ensuring that investors receive clear, reliable data to build their confidence in your company.

The Challenges CFOs Face in Fundraising

Leading a fundraising process presents several hurdles, especially if it’s your first time:

- Building Financial Models

You need to create financial models that can withstand the scrutiny of investors, which can be difficult without prior experience. - Valuing Non-Listed Companies

Determining reliable business valuations can be a challenge, especially for companies not yet publicly listed. - Creating Effective Pitch Documents

Crafting documents that generate excitement and attract the right investors is critical, but can feel daunting. - Building Investor Relationships

Quickly establishing trust and enthusiasm with potential investors, who may have limited knowledge of your company, is essential. You must anticipate their concerns while navigating their industry insights and perspectives

The Time-Consuming Nature of Fundraising

Fundraising is complex and time-intensive, requiring CFOs to:

- Balance operations and deal management – Juggling stakeholders while keeping the business running.

- Manage due diligence and negotiations – Understanding legal clauses and deal terms is crucial to avoid costly mistakes.

For aspiring CFOs, fundraising experience can be a career-defining advantage. Without it, you may struggle to:

- Secure a CFO role – Lack of fundraising experience is a common barrier.

- Navigate recruitment – Many candidates underestimate the complexities of leading a round.

The good news? Even without direct experience, key skills like influencing, negotiating, and project management can set you up for success. And understanding the different stages of fundraising will help you confidently navigate the process:

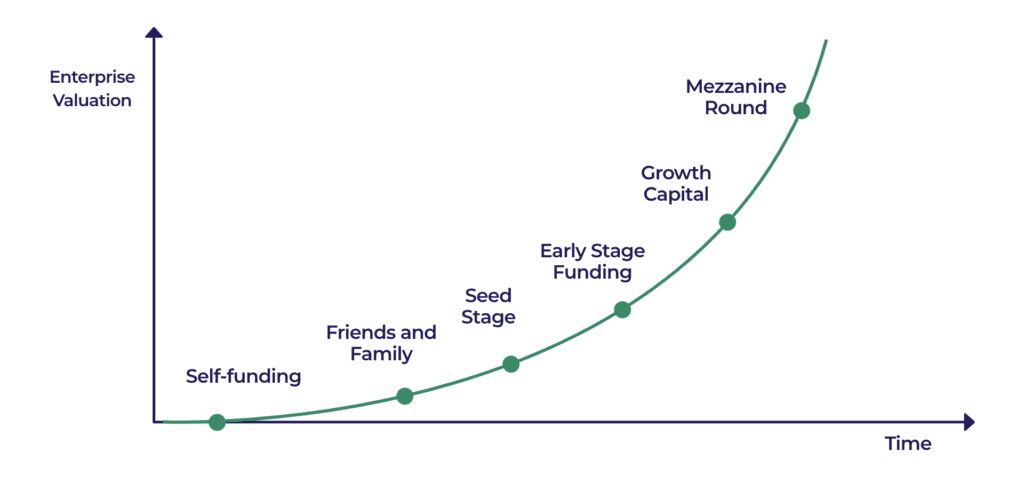

A typical company’s fundraising life cycle consists of six stages as outlined in the following diagram. Note that the sizes and equity stakes may differ per sector and geography:

- Self-Funding

- What it is: The founder’s personal capital to start the business.

- Friends and Family

- Funding Amount: $50k – $200k for < 5% equity.

- Purpose: Early funds to kickstart operations. Avoid giving away too much equity.

- Seed Stage

- Funding Amount: $0.5m – $2m for < 20% equity.

- What It Is: External funding from angel investors, often in two phases, to grow the business.

- Early-Stage Funding

- Funding Amount: $3m – $5m for 20% equity (Series A).

- What It Is: Capital from venture firms or high-net-worth individuals as the company formalizes its leadership team.

- Growth Capital

- What It Is: Funding once revenue exceeds $5m and scalability is proven.

- Equity Stakes: Founders often retain < 10% equity in a company valued at $30m+.

- Investors: Mid-market private equity houses and trade investors.

- Mezzanine Round

- Funding Amount: For companies valued between $100m and $1bn.

What It Is: The final round before an exit, often from large private equity or trade investors.

In today’s dynamic financial landscape, fundraising opportunities are more abundant than ever. It’s crucial to position yourself strategically for success, ensuring you’re prepared when the need arises.

Are you ready to elevate your finance leadership and drive transformative change? Join us at the Future CFO Program Preview Event, where you’ll meet like-minded aspiring CFOs and learn more about the program designed to equip you with the strategies, tools, and insights to become a visionary leader.

Seize the opportunity to accelerate your career and secure long-term success.

Responses