How to Assess if an Acquisition is Worth it?

For CFOs and finance leaders, understanding acquisitions is crucial to driving growth. Acquisitions can be a powerful strategy for businesses with strong access to finance, such as private equity-backed companies, scaled-up owner-managed businesses, or cash-rich family offices.

Why Acquisitions Matter: Acquiring another company can offer significant benefits:

- Immediate access to new markets

- High-value clients

- Talented employees

- Advanced technology

These advantages can fast-track your business plan and create new opportunities for growth.

The Risks to Consider: While acquisitions offer great potential, there are also risks involved:

- Overpaying for the target company

- Struggling to integrate the acquired company and its people

- Facing regulatory challenges

CFOs must carefully assess these risks to avoid costly mistakes. The success of an acquisition depends on a well-structured M&A strategy, thorough due diligence on the target company, and seamless integration into your existing operations.

Given the complexity of the deal process, including assessing the target’s financial health, size, and cultural compatibility, CFOs are integral in guiding the company through each stage.

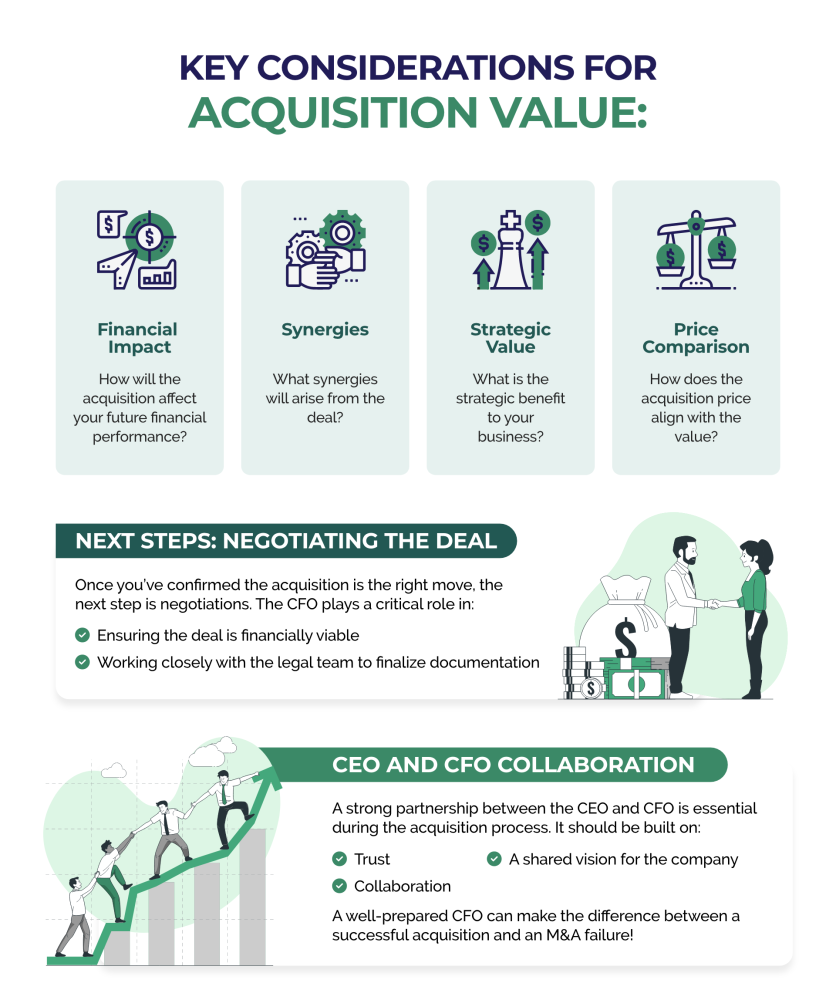

Early into an acquisition process, you should determine whether it offers good value for money. Here are some consideration factors:

- How will the acquisition affect your future financial performance?

- What synergies would arise from completing the deal?

- What is the strategic value to your business?

- How does this compare to the acquisition price?

The CFO’s Role During an Acquisition:

- Financial Oversight: CFOs are responsible for ensuring that the financial aspects of the deal are properly managed and that both companies get a fair deal.

- Time Commitment: The acquisition process will consume a significant amount of your time, so it’s crucial to have the right support in place.

- Ongoing Responsibilities: Develop a plan to ensure that your finance function continues to meet its day-to-day requirements while navigating the acquisition process.

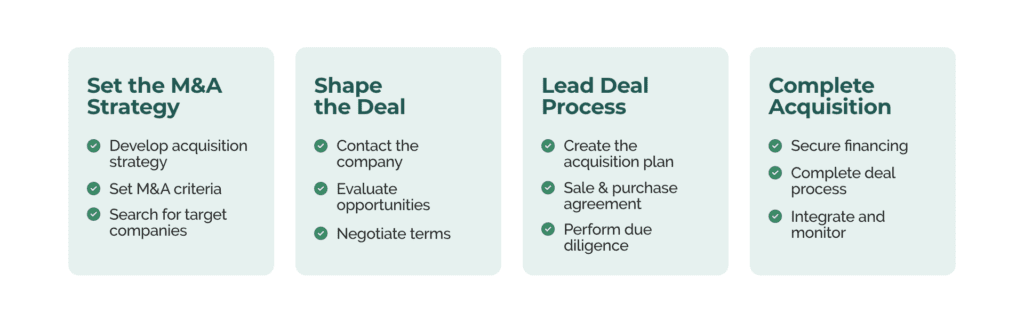

The CFO’s role is vital at every stage of the deal, balancing both the acquisition and ongoing financial duties. The following diagram outlines some of the key activities undertaken by the CFO during a typical deal cycle:

The role of the CFO is critical to the success of any acquisition. From setting the M&A strategy to evaluating opportunities, the CFO leads the due diligence process to ensure that the target company aligns with your business goals.

As the deal progresses, CFOs are responsible for financing the acquisition and managing key aspects, such as:

- Reviewing legal documents

- Supporting negotiations

- Ensuring the transaction is financially sound

The first 100 days post-acquisition are the most crucial in driving success. During this period, the CFO must:

- Set financial targets

- Align incentives

- Track performance to ensure the deal delivers on its promises

Integrating the two businesses and realizing synergies can be challenging, especially when dealing with larger companies or cross-border transactions. The CFO will oversee the integration process, ensuring costs are controlled and synergies are realized.

Additionally, the CFO must monitor:

- Compliance with financial covenants

- Progress toward earn-out targets

This ensures the company meets stakeholder expectations and avoids breaching any contractual terms.

With meticulous planning and strong execution, the CFO plays a key role in ensuring the acquisition delivers the desired growth and value.

Are you ready to take on the CFO role?

Sign up for our Future CFO Program preview event.

Responses