Why 70% of M&As Fail — And How CFOs Can Beat the Odds

Did you know that nearly 70% of mergers and acquisitions fail to meet their financial goals? This highlights why every CFO, or aspiring CFO, must master the complexities of company exits.

A successful exit can be life-changing for shareholders, but the process is often more challenging than expected. Whether it’s a trade sale, private equity buyout, or IPO, many deals break down during negotiations, and completed transactions often fall short of expectations.

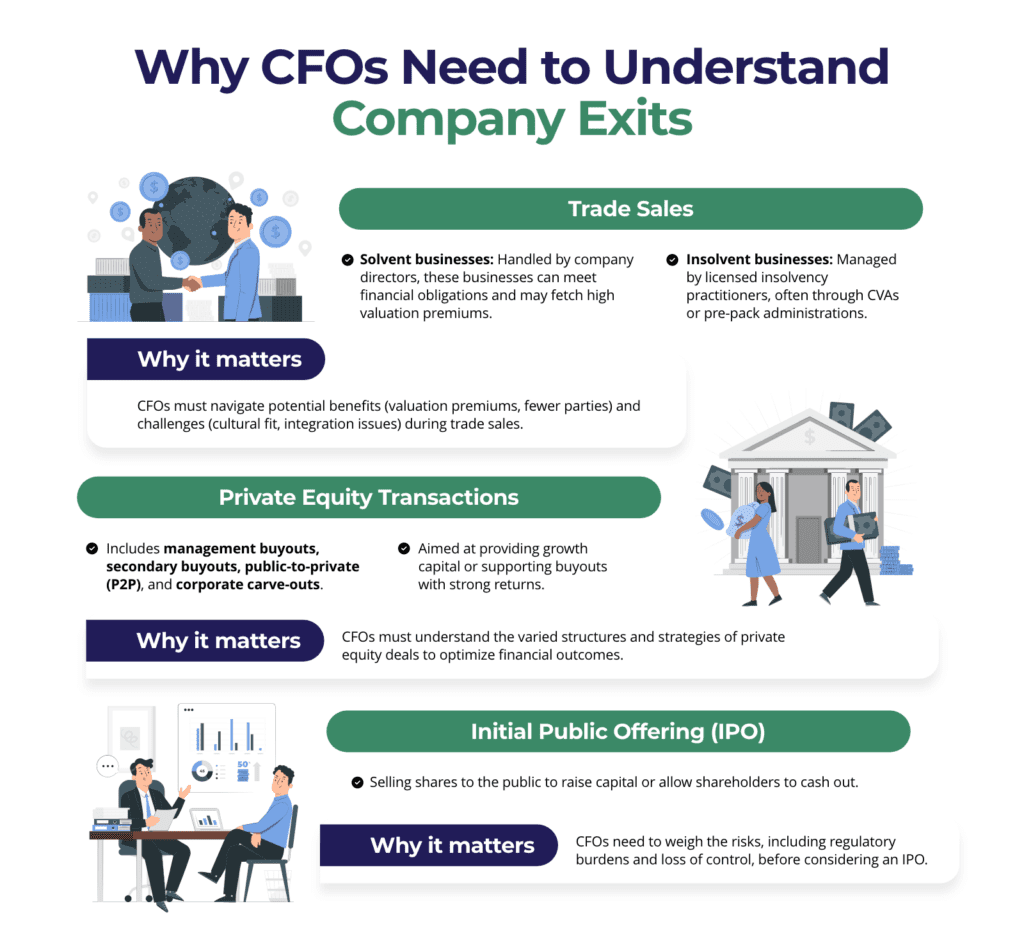

Trade sales, where businesses sell fully or partially through share capital or assets, are common among management teams and investors. However, understanding the financial and operational risks involved is crucial to ensuring a successful outcome.

Trade sales come in two main types:

- Solvent businesses: These are companies that can meet their debts and financial obligations. Typically, company directors handle these sales.

- Insolvent businesses: These companies are either insolvent or facing legal action from creditors. A licensed insolvency practitioner usually manages these sales through processes like Company Voluntary Arrangements (CVA) or pre-pack administrations.

Trade sales offer several benefits, including the potential for significant valuation premiums and a lower chance of a deal falling through when fewer parties are involved. However, challenges can arise, such as cultural mismatches between the businesses and integration issues post-sale.

Private equity transactions come in various forms, such as management buyouts, secondary buyouts, public-to-private (P2P), and corporate carve-outs. The size, nature, and structure of these deals vary, but they generally aim to provide growth capital or support buyouts of businesses that can deliver strong returns over a set lifecycle.

An Initial Public Offering (IPO) is when a company sells shares to the public for the first time. This is often done to raise capital, but it can also be a way for current shareholders to cash out. While IPOs can be lucrative, they are risky, and many companies avoid them to retain control and avoid the regulatory burden.

Why CFOs Need to Plan for a Successful Exit Early

- Career Milestone: A successful exit is a major achievement and key career moment for any CFO.

- The Problem: 40% of CFOs wait until one year before their target exit to start planning, leaving insufficient time to execute all necessary activities and impact financial performance.

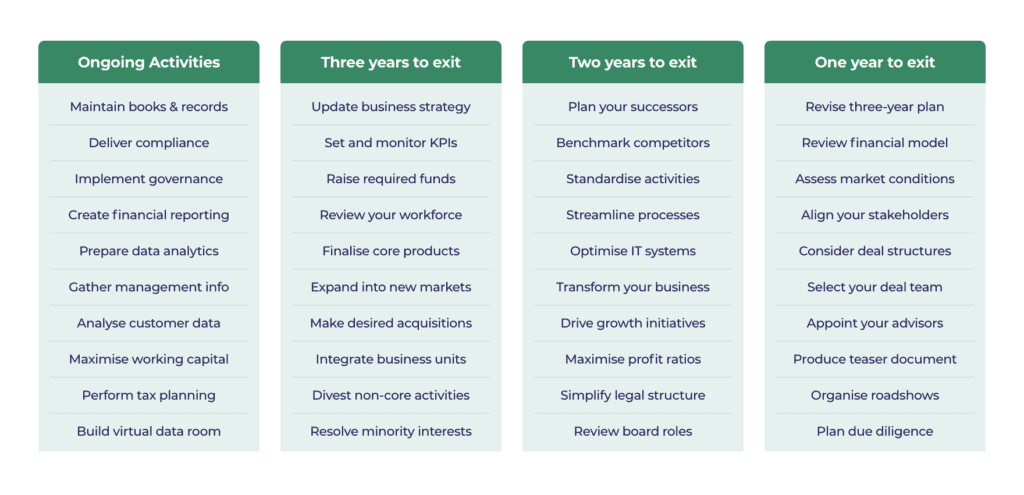

Early preparation ensures financial goals are met and exit activities are fully implemented, maximizing the impact on your company’s future. CFOs should focus on exit readiness activities 3 years ahead of the planned exit.

Companies must begin planning well in advance of any targeted exit date, staying prepared for an unexpected lucrative approach from a potential buyer. Experienced CFOs often start exit planning immediately after fundraising, giving them ample time to build the data room and prepare for due diligence.

Begin by identifying your company’s unique selling points, understanding why a buyer would be interested, and focusing on the KPIs that matter most. You should also decide if you need an advisor and start working with them early—well before the live deal process begins.

If you’re ready to tackle real-world challenges and master the art of successful company exits, don’t miss the Future CFO Program preview event. This program is designed to equip aspiring and current CFOs with the skills needed to navigate complex deals, drive growth, and solve real-world financial challenges.

Spots are limited — register now to secure your place.

Responses